Low margin rate and no commission trading

Margin Rates

as Low as 6.8%

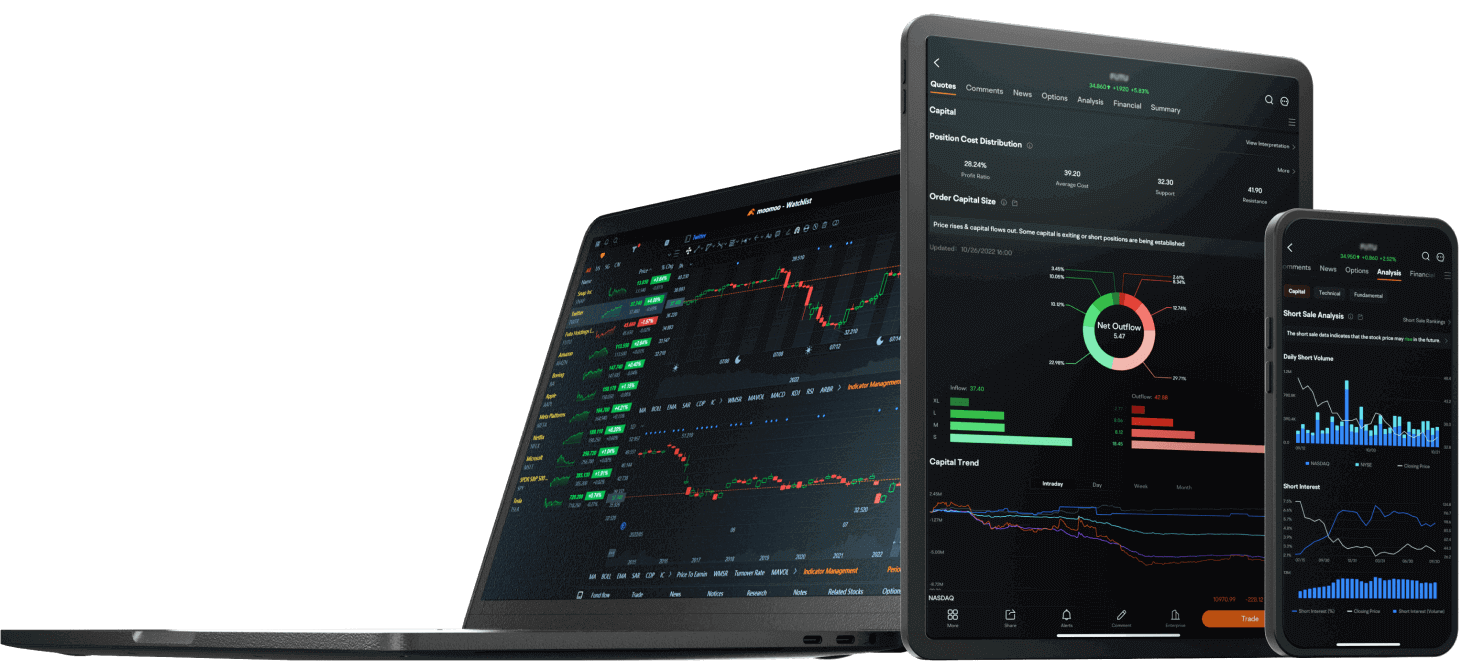

All-in-One professional platforms

Disclosure

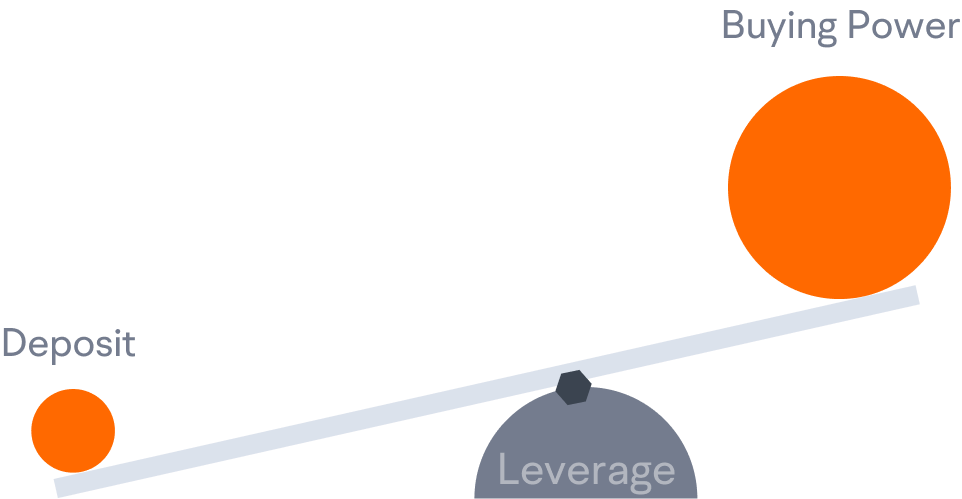

What is Margin Trading?

Trading securities on margin* is most commonly understood as borrowing money from a broker to buy a stock.When buying on margin, the investor uses the marginable securities or cash in their brokerage account as collateral to secure the loan. The collateralized loan comes with an interest rate that will be calculated periodically and charged. While margin trading increases your purchasing power, it’s important to understand that with the potential for higher returns, there’s also more risk.

How Margin Trading works?

Margin trading allows investors to borrow funds from a broker to purchase securities, using the marginable cash and securities already held in their account as collateral. Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments.

Learn more

Disclosure

Brokerage

Margin Rate

(balance < $25K)

6.8%

TD Ameritrade

14.25%

Fidelity

13.3255%

Charles Schwab

13.325%

E*TRADE

13.70%

Data Sources:Official website of brokerages as of 5/10/2023

Low Margin Rates* ,

$0 Commission

Pay $0 in commission and get margin interest rates*as low as 6.8% on moomoo.

See pricing for details

Disclosure

Open an account

Sign up and register now

Fund your account

Deposit at least $2000 to use the margin account

Start buying on margin

Start margin trading on moomoo with $0 commission

Understanding the Risks of Margin Trading

Margin trading should only be pursued by experienced traders with high-risk tolerance . Even experienced trader may have losses far higher than their original investment.

Before you start margin borrowing, you should know the risks:

- You must regularly monitor your account to help manage market risk from the fluctuations of your chosen securities.

- Leveraging investments increases risk, as you must pay the loan regardless of the underlying securities’ values.

- Margin loan interest rates may increase at any time, which would increase your costs.

- There are account value requirements that must be met, and your securities may be liquidated.

Learn More about

Margin Trading

Margin Trading

FAQS

What is the Benefit of a Margin Trading?

With Margin trading you could :

1. Use the cash or securities in your account as leverage

2. Build your toolbox and diversify your strategies with the ability to short-sell

3. Adding margin trading to your strategy may help expand your portfolios

1. Use the cash or securities in your account as leverage

2. Build your toolbox and diversify your strategies with the ability to short-sell

3. Adding margin trading to your strategy may help expand your portfolios

Why use moomoo margin trading?

• Low margin rate and no commission trading

Pay $0 in commission* and get margin interest rates as low as 6.8% on moomoo.

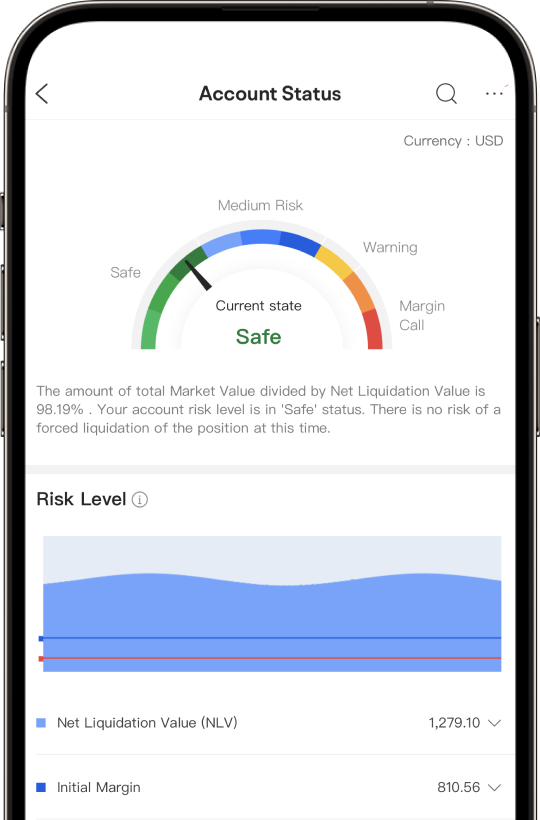

• Real-time Risk Monitoring

Easily monitor your margin balances and buying power with real-time updates and alerts.

• All-in-One tools and platform

A powerful suite of tools for research and analysis on mobile and desktop, including stock screeners with 100+ indicators, advanced charting tools, and AI-driven alerts.

• High-quality data to power your decision-making

Take advantage of real-time level 2 market data*, daily short-sale analyses, and market news from 200+ resources and more.

• Dedicated Customer Service

Get support from licensed professionals via phone, email, or live chat for any questions on margin trading.

Pay $0 in commission* and get margin interest rates as low as 6.8% on moomoo.

• Real-time Risk Monitoring

Easily monitor your margin balances and buying power with real-time updates and alerts.

• All-in-One tools and platform

A powerful suite of tools for research and analysis on mobile and desktop, including stock screeners with 100+ indicators, advanced charting tools, and AI-driven alerts.

• High-quality data to power your decision-making

Take advantage of real-time level 2 market data*, daily short-sale analyses, and market news from 200+ resources and more.

• Dedicated Customer Service

Get support from licensed professionals via phone, email, or live chat for any questions on margin trading.

Disclosure

What's the minimum net asset to use margin on moomoo?

You can buy on margin if you have net assets of $2,000.

How do I trade using margin on the moomoo app?

To trade margin on the moomoo app, you must first open a brokerage account with Mooomoo Financial Inc.

Simply click ‘Quotes’ at the bottom left-hand side of the app. Locate the stock that you are interested in. Look for the 'Long Margin' icon to see if a stock is available for buying on margin, then tap the trade button. See our video to learn more.

Simply click ‘Quotes’ at the bottom left-hand side of the app. Locate the stock that you are interested in. Look for the 'Long Margin' icon to see if a stock is available for buying on margin, then tap the trade button. See our video to learn more.